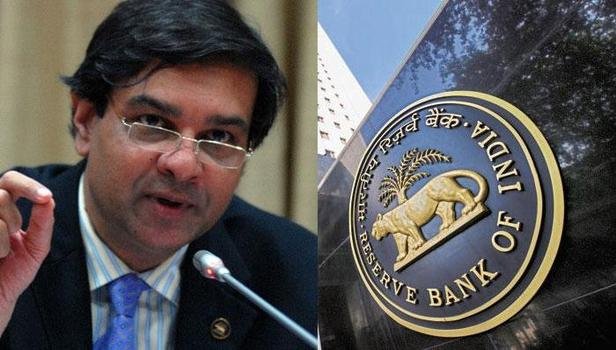

Debt Waiver Increases the Burden On Government Treasury: RBI Governor

06 Apr 2017 ( IBTN News Bureau )

The Uttar Pradesh government has announced to waive the debt of farmers for one lakh rupees. On Thursday, the Governor of Reserve Bank of India released a monetary policy. RBI Governor Urjit Patel described the decision of Uttar Pradesh government as a matter of concern.

While completing his election promise in his first Cabinet meeting, the Uttar Pradesh Government took a decision to waive loans of 36,359 crores of small farmers.

Commenting on the negative aspects of the decision, such as loan waiver by the RBI, the RBI governor said that it increases moral hazard.

Urjit Patel said, steps like loan forgiveness have an impact in the Government treasury, which is already in the deficit.

Loan apology can pose a risk of inflation going up.

Urjit said that the debt forgiveness also increases the hassle of banks. At the same time, the burden on taxpayers increases.

He said that there should be an agreement on whether the promise of loan forgiveness should not be done in the election campaign. It is being said that the Uttar Pradesh government will apologize for the loan bonds of Rs 36,359 crore. However the Government treasure is not in the right position. The loss of Uttar Pradesh Government is at the highest level of 4 years. If you talk about three big states, the worst state of them is Uttar Pradesh.

In monetary policy review, the RBI retained the repo rate at 6.25%. However, the reverse repo rate has been increased from 5.75 percent to 6 percent. That is, the difference in repo rate and reverse repo rate has come down from 0.50 percent to 0.25 percent.

According to the Reserve Bank, in the next half year (April-September), the Consumer Price Index (CPI) based inflation (CPI) will be 4.5 per cent, whereas in the next six months (October-March half yearly), inflation has been estimated at 5 per cent.

The bank also has to take a loan for its work. In this case, all banks borrow from the Reserve Bank of India (RBI). The rate at which the Reserve Bank charges interest from them is called a repo rate. If banks get money on cheap interest, then it will be able to provide cheap loans to people whose interest rates will be low. When the bank has more money, then it keeps its money with the Reserve Bank of India. The RBI gives them interest on this. That is, the interest given by the RBI is called the Reserve Repo Rate.

(Click here for Android APP of IBTN. You can follow us on facebook and Twitter)

Share This News

About sharing

-

15 Nov 2025

Why did the Grand Alliance suffer a crushing defeat in the 2025 Bihar Assembly elections?: Analysis

15 Nov 2025

Why did the Grand Alliance suffer a crushing defeat in the 2025 Bihar Assembly elections?: Analysis

Why did the Grand Alliance suffer a crushing defeat in the 2025 Bihar Assembly elec...

-

12 Nov 2025

LIVE: India, Pakistan launch probes after blasts in New Delhi, Islamabad

12 Nov 2025

LIVE: India, Pakistan launch probes after blasts in New Delhi, Islamabad

LIVE: India, Pakistan launch probes after blasts in New Delhi, Islamabad

-

11 Nov 2025

Delhi Red Fort blast live: Terrorism law invoked in India after 13 killed

11 Nov 2025

Delhi Red Fort blast live: Terrorism law invoked in India after 13 killed

Delhi Red Fort blast live: Terrorism law invoked in India after 13 killed<...

-

05 Aug 2025

At least four dead, dozens missing as flash floods hit north India village

05 Aug 2025

At least four dead, dozens missing as flash floods hit north India village

At least four dead, dozens missing as flash floods hit north India village

-

12 Jun 2025

Air India flight crashes in Ahmedabad with more than 240 people on board

12 Jun 2025

Air India flight crashes in Ahmedabad with more than 240 people on board

Air India flight crashes in Ahmedabad with more than 240 people on board